There are many interesting things going on as we enter the fourth quarter of 2022.

Inflation:

Consumer prices (groceries, utilities, retail, etc) are continuing to rise and I do not see anything in the works to reduce that soon. The Federal Reserve has increased interest rates twice already and the Chairman, Jerome Powell, has indicated it will continue to increase. Most likely, the Fed will gift us with another interest rate spike before Christmas. Building supply costs have also increased, lumber prices are high and skilled labor is hard to find. Some builders also need funding (a loan that incurs interest) to build, remodel or renovate a home, making interest rates impactful as well.

Taxes:

When property values go up, so does the amount you owe in property taxes. Current homeowners are feeling the squeeze of inflated home prices. If you are buying a house for $100k more than the current taxable value, that means your taxes will reflect that new price. Don’t forget to account for taxes when looking at what home you want to purchase or part of town you are renting. Some cities/counties have additional taxes outside of standard property taxes. Do your research as this will impact what you will be able to buy.

Buyers:

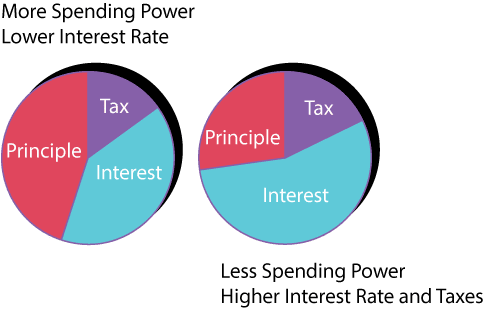

So what does that mean for you? It will cost more to own and rent a house. Your home payment consists of property taxes, interest charges and principle. If you only have $1500 to spend every month on your home, then property taxes and interest play an important role in regards to what you can afford. In April, interest rates were around 2-3%. With a low rate, that means your interest payment is smaller, allowing you to put more money toward principle, meaning you can spend more money on your house. Now, interest rates are around 6-7%. That’s more than double from five months ago.

When looking at what house you want to buy, your money won’t go as far because interest is taking up a bigger piece of the pie. Similarly, with property taxes, the more house you buy, the more you pay in taxes. However, with home prices inflated substantially, you now have to pay more in taxes for less house. Therefore, the current market is not great for buyers unless you have cash. If you are looking to buy, wait. Renew your lease for one more year. 2023, housing prices should come back down and level out. Interest will remain high but lower purchase price also means lower taxes.

Renters:

As you have seen, inflation, housing prices and property taxes have all increased dramatically in 2022. That means renters are being dragged along for the ride. Local governments are valuing property $100,000 more than it was valued the previous tax year on average. Higher property taxes means higher rents to cover the expense. Similarly, why would a landlord want to keep a renter in the property when they can sell the property for big bucks? The landlord will choose to raise the rent.

This blog seems targeted to buyers, but if you want to sell your home before next summer, this is something you will need to keep in mind. When deciding what price to list your house for, you will need to take into current economic factors like interest rates and taxes.

If you would like more information, leave a comment or contact me.