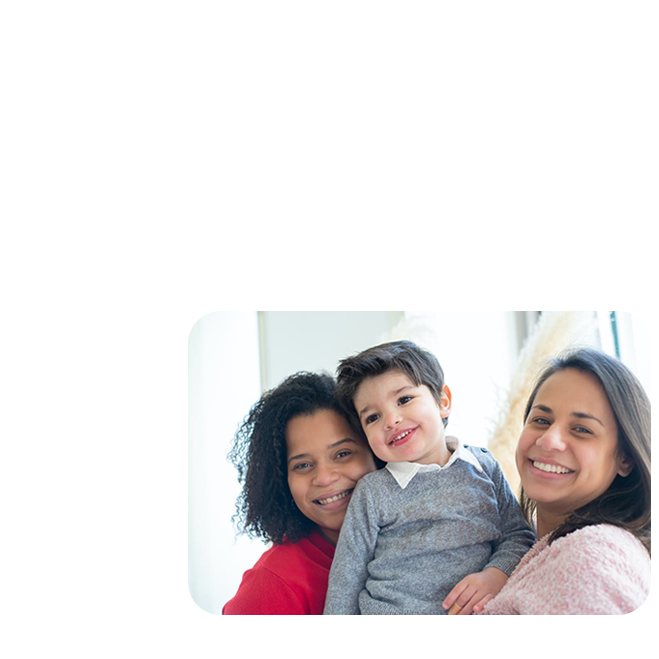

Housing disparity in the U.S. by race is a significant issue, with Black and Hispanic Americans experiencing higher rates of housing hardship and lower rates of homeownership than White Americans.

Race and Lending

The Racial Wealth Gap

According to the U.S. Census Bureau, there is a large gap in owning a home. Below is percentage homeownership by race. Why are these stats important? If you own your home, you can pass on that asset or “wealth” to the next generation. This allows the next generation to allocate the monies they would have spent on housing to be put towards savings or paying for a college degree.

Non-Hispanic White

Black

Hispanic

The wealth generation gap in home ownership refers to the disparity in home ownership rates and the accumulation of home equity between different demographic groups, often based on factors such as race, ethnicity, and socioeconomic status. A source of social and economic inequality, this gap can have significant implications for individuals and communities, as home ownership is often a key component of long-term financial stability and wealth accumulation. As a result, certain groups, particularly communities of color and low-income households, have faced significant barriers to achieving home ownership and accumulating wealth through home equity.

It is important to approach this topic with sensitivity and respect, recognizing the historical and systemic factors that have contributed to the wealth generation gap in home ownership. These factors include:

Yarlow is looking to partner with Home Service Professionals to provide education and discounted services to first generational homeowners. If you know someone or if you are interested in making a difference, email BridgingTheGap@Yarlow.com

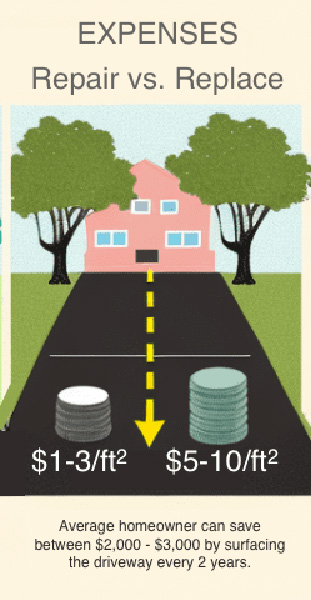

In this example, homeowners can save an average of $2,000 – $3,000 by hiring a professional to perform sealing maintenance every 2 years in harsh climates like Minnesota. That’s a substantial cost savings when you have limited savings.

Identifying and addressing small issues before they become larger problems, can save money and avoid the inconvenience of unexpected repairs. Maintaining a well-cared-for home also enhances its curb appeal, making it a more comfortable and living space. Additionally, keeping up with maintenance can increase the lifespan of home systems and appliances, leading to greater sustainability and reduced waste.

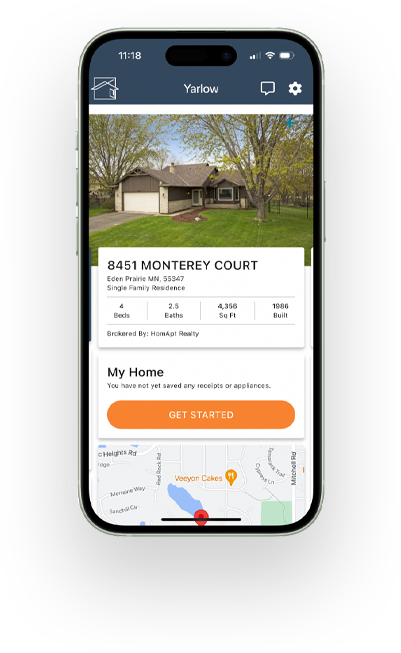

Yarlow provides maintenance alerts to help educate homeowners about when and how to perform maintenance. Storing receipts allows users to review the maintenance history on their home and budget for upcoming costs. These simple tools can make a big difference in the home owning experience and offer several benefits.

Download The Yarlow

App Today

Get a custom guide that helps you track, maintain and update your home.